This might not be the typical expat blog, written by a German expat, living in the Philippines since 1999. It's different. In English and in German. Check it out! Enjoy reading! Dies mag' nun wirklich nicht der typische Auswandererblog eines Deutschen auf den Philippinen sein. Er soll etwas anders sein. In Englisch und in Deutsch! Viel Spass beim Lesen!

You plan to move to the Philippines? Wollen Sie auf den Philippinen leben?

Ja, es gibt tonnenweise Webseiten, die Ihnen sagen wie, warum, vielleicht warum nicht und wann Sie am besten auf die Philippinen auswandern könnten. Ich möchte Ihnen in Zukunft "zwischen den Zeilen" einige zusätzlichen Dinge berichten und erzählen. Viel Spass beim Lesen und Gute Unterhaltung!

Total Pageviews

Wednesday, April 3, 2024

DOH chief reminds public: Hydrate, ‘cool off’ vs summer diseases

By: Maila Ager - Reporter / @MAgerINQ

MANILA, Philippines — Summer time is here, and so are heat-related illnesses.

Health Secretary Teodoro Herbosa on Tuesday explained that heat-related diseases are due to long exposure to the sun.

“Ang unang sign niyan [ay] dehydration, uhaw. Pangalawa: fatigue, ‘yung heat exhaustion, madaling mapapagod, tapos nun magkakaroon ng heat fatigue, tapos magkakaroon ng heat stroke,” Herbosa said in an interview in the Senate.

(The first signs are dehydration and thirst. Secondly, fatigue and heat exhaustion — you become easily tired, leading to heat fatigue, and eventually, heat stroke.)

“’Yung heat stroke hinimatay, ‘yung nag-collapse sa init, so ‘yung heat stroke madadala na kayo sa emergency room,” he added.

(A heat stroke can cause fainting or collapsing due to the heat. So, if you experience a heat stroke, you may need to be taken to the emergency room.)

To prevent falling ill due to hot weather conditions, the health chief advised the public to drink water and “cool off” or go to a cooler place.

“Kailangan ‘pag nag-umpisa pa lang ‘yung pakiramdam ng thirst, mag-hydrate na,” Herbosa said.

(When you start feeling thirsty, it’s important to drink water to hydrate immediately.)

“’Pag nakaramdam ng heat exhaustion, ‘yung parang pagod na pagod at parang lanta na yung katawan mo… mag-cool off na kayo.”

(When you start feeling heat exhaustion, or extremely tired and your body feels drained… it’s time to cool off.)

“You better go to a cooler place. Huwag masyadong mabilis cooling at kailangan ‘wag masyadong malamig ang inumin ng tubig kasi pwede ring magkaroon ng side effect,” he added.

(You better go to a cooler place. Don’t cool down too quickly, and make sure not to drink water that is too cold as doing this may also have side effects.)

To cool down, Herbosa said one may look for a covered place first, preferably under a roof or tree, or go to an air-conditioned room before taking a shower.

Long exposure to the sun is more dangerous for individuals with hypertension, heart ailments, and other existing illnesses, the health chief warned.

“Kung ikaw may hypertension [at] mapunta ka sa init ng araw, baka makaroon ka ng heart attack or heat stroke. Hindi lang heat stroke, [kundi] totoong stroke,” he said.

(If you have hypertension and you expose yourself to the heat of the sun, you might have a heart attack or heat stroke. Not just heat stroke; it can be a real stroke)

“Every time we have other illnesses, whether it’s kidney failure, cancer, mahirap ma-expose sa extremes ng weather, so very important to protect yourself, ‘wag pong maglagi sa labas,” he added.

(When we have other illnesses, such as kidney failure or cancer, it’s difficult to expose ourselves to extreme weather conditions, so it’s very important to protect yourself. Avoid staying outdoors for too long.)

Herbosa said other common diseases during summer include food-related and water-borne illnesses.

“Kasi ‘yung food, pagdating ng hapon, during hot weather, ‘yung niluto mo kaninang umaga, sa hapon panis na yun. Dati, ‘pag cooler ang weather, medyo mas tumatagal,” he pointed out.

(During hot weather, the food you cook in the morning might already be spoiled in the afternoon. In the past, when the weather was cooler, it used to last a bit longer.)

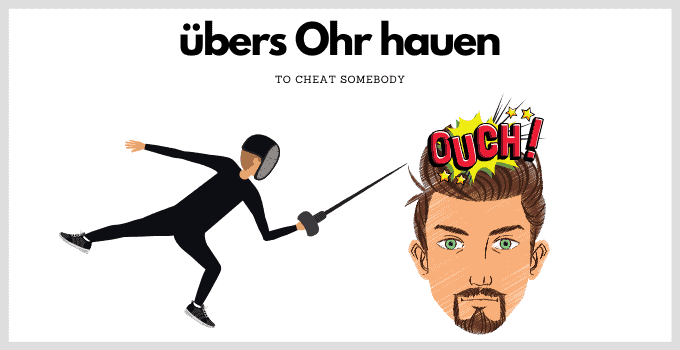

The 34 Very Best German Sayings…EVER!: 23. übers Ohr hauen

The 34 Very Best German Sayings…EVER!

By: AuthorMarcel Iseli

23. übers Ohr hauen

If you do this anyway, you have bamboozled (cheated) your opponent, which in German is also called ‘übers Ohr hauen.’

Example:

Du bist aber auch wirklich naiv! Meinst du wirklich, dass dir Bernd einfach so 1000 Franken schenkt? Der hat dich doch übers Ohr gehauen!

Translation: You are really naive! Do you really think Bernd will give you 1000 dollars just like that? He’s definitely up to something!

PH, EU launch disaster risk reduction and management program to enhance LGUs readiness capacities

The Disaster Risk Reduction Enhancement at the Local Level Technical Assistance (DRREALL TA) Program aims to support the DILG in reinforcing local government units, specifically in building and enhancing existing capabilities in key DRRM aspects. The DRREALL TA Program will cover activities to address critical gaps, namely, risk-informed planning, integrated capacity development strategies, effective local DRRM funds' utilization, and gender sensitive and socially inclusive disaster response towards ensuring the readiness and protection of citizens especially the vulnerable.

The program also aims to conduct high-level policy dialogue among government and non-government stakeholders in setting important policy directions and solutions that foster co-ownership and accountability.

Co-funded by the EU and the AFD, the €4.28 million or P256 million technical assistance accompanies a programmatic policy-based loan by the French government amounting to €250 million to the government of the Philippines in 2021.

The DRREALL TA Program will be implemented by the Expertise France and will run from 2024 to 2027 in close partnership among DILG, LGUs, partner national agencies and French institutions.

In a recorded statement, the DOF said that the DRREALL Program is a fitting solution to the Philippines' ongoing battle against climate change. "Given our archipelagic nature, each locality in the Philippines faces its own unique set of challenges and vulnerabilities. This [DRREALL Program] will allow us to empower our local government units as we develop climate projects and programs uniquely tailored to their specific needs. By doing so, we ensure sensitivity to localities and increase the likelihood of achieving the greatest positive impact for our people," said Secretary Ralph G. Recto.

EU Ambassador Luc Véron stated, "The European Union is proud to be able to continue supporting the Philippines' efforts to improve the country's climate resilience, most especially at the local level, through blended financing, in partnership with AFD. This project responds fully to the Government's objective to address Climate Change in a more effective and coordinated manner, and should help to take practical steps and support LGUs to move from plans to action. DRREALL is one element in a larger framework of partnership - the Team Europe Green Economy Initiative. As part of this initiative, the EU launched recently the €60 million EU-Philippines Green Economy Programme, which will focus on the Philippines' transition towards a more circular economy, reducing waste and plastic, as well as increasing energy efficiency and renewable energy."

"The DILG stands firm in our mandate to lead local government units in shaping strategies for local governance, including developing policies, and programs relevant to protecting most especially our local citizens from natural and human-induced hazards. The strengthening of LGUs in delivering devolved services will always be at the forefront of our vision for a climate resilient Philippines. We encourage all stakeholders identified in the implementation of the DRREALL TA activities, to pledge their active engagement, valuable knowledge, and technical expertise for the successful implementation of the Program", said DILG Undersecretary Marlo L. Iringan.

For Philippe Orliange, AFD Executive Director of All Countries' Operation, the Philippines is an important stakeholder in advancing France's Indo-Pacific strategy. "The Southeast Asian region houses 14 of the 20 most climate-exposed countries, 54 percent of the global population, and contributes to 40 percent of the global GDP. Through a €250 million policy-based operation in 2021, AFD demonstrated its commitment to a long-term partnership with the Philippines on a territorial approach to enhance adaptation capacities to climate change. Further, we are mobilizing our French expertise network through the CEREMA (public expertise agency for ecological transition and regional planning) for flood risk planning and Expertise France as DRREALL TA project implementor."

National Committee on Language and Translation announces Rolando S. Tinio Translator’s Prize winners 2024

Ariel S. Tabag, of Bannawag Magazine, receives the prize award in the novel category

The National Commission for Culture and the Arts (NCCA), led by the National Committee on Language and Translation (NCLT), announced the winners of the Rolando S. Tinio Translator’s Prize on April 2, 2024.

This award aims to give greater prominence to the translation of texts and works written in various languages in the Philippines into the national language.

The two awardees are Ariel S. Tabag in the novel category and Manu Avenido in the poetry category.

Notably, Ariel is one of the editors of Bannawag Magazine, which is one of the nine magazines published by the Manila Bulletin. He also founded and oversees the Sanita Literary Awards and serves as the President of GUMIL Filipinas, the association of Ilocano writers in the Philippines and overseas.

Ariel is the author of "Karapote" (a collection of Ilokano stories, 2011), "Ay, Ni Reberen!" (an Ilokano novel, 2013), "Voice Tape and Other Selected Stories" (a collection of selected Ilokano stories, 2022), and "Manen, Adda Umuna" (a collection of Ilokano poems, 2023).

Meanwhile, Manu Avenido is a multilingual fictionist, poet, and playwright from Bohol. He has won the Palanca Award four times for his short stories in Cebuano. He has also been honored in competitions such as the Lumbera Awards, BATHALAD-Mindanao, Sinulog Awards for Literature (SINULAT), Balacuit, Kinalitkalit Flash Fiction Writing Contest, among others. Additionally, he has been a fellow in regional and national workshops including Faigao, lyas, ligan, and Lamiraw.

Most of Manu's short stories have been published in Bisaya Magasin and other anthologies. His debut collection of award-winning short stories, titled "Ikigai Ug Ubang Piniling Mga Sugilanon" (Advaux, 2023), with an English translation by Dr. Marjorie Evasco, received a Publication Grant in 2023 from the National Book Development Board.

If we could only readily welcome God in our life

By Fr. Roy Cimagala

Chaplain

Center for Industrial Technology and Enterprise (CITE)

Talamban, Cebu City

Email: roycimagala@gmail.com

WE should do everything to be able to readily welcome God in our life. When we manage to do so, we would be apt to share his power too, and like him we can do great things, even miraculous things.

We are reminded of this truth of our Christian faith in the first reading of the Mass of Wednesday of the Easter Octave. (cfr. Acts 3,1-10) Sts. Peter and John went to the temple area and met a crippled man who begged for some alms. But instead of giving alms, St. Peter, strongly invoking the name of Christ, told the fellow to rise and walk, and the cripple started to walk!

“I have neither silver nor gold,” St. Peter told the cripple, “but what I do have I give you: in the name of Jesus Christ the Nazorean, rise and walk.” And the miracle happened.

We should strengthen our belief that if we truly welcome in our life God who, in the first place, takes the initiative to share what he has with us, we too can do what God can. We would be apt to do great things. Obviously, what God shares with us can only be what is truly good for us. We cannot and should not invoke his name to do something that is evil or not in accordance to the will of God.

Let’s remind ourselves frequently, if not constantly, of this wonderful reality, so that we can truly say that we are doing things always with God and not simply by our own selves. It’s not presumptuous of us to remind ourselves of this truth of our faith. We really are meant to share our life with God.

This awareness and conviction of this truth of our faith is necessary for us, since we cannot deny that in our life we will encounter all sorts of challenges, difficulties and temptations and sin, and we should just know how to handle them properly.

When these challenges, difficulties, etc. come, we should immediately remind ourselves of this wonderful truth that God is always with us and is eager to help us, though in ways that may not be accordance to our expectations.

A healthy spirit of abandonment in God’s hands is necessary even as we exhaust all possible human means to achieve our goals or simply to tackle all the challenges, trials and predicaments of our life. We should never forget this truth of our faith.

In this life, we need to acquire a good, healthy sporting spirit, because life is actually like a game. Yes, life is like a game. We set out to pursue a goal, we have to follow certain rules, we are given some means, tools and instruments, we are primed to win and we do our best, but losses can come, and yet, we just have to move on.

Woe to us when we get stuck with our defeats and failures, developing a loser’s mentality. That would be the epic fail that puts a period and a finis in a hanging narrative, when a comma, a colon or semi-colon would have sufficed.

We need a sporting spirit because life’s true failure can come only when we choose not to have hope. That happens when our vision and understanding of things is narrow and limited, confined only to the here and now and ignorant of the transcendent reality of the spiritual and supernatural world.

4 planets aligning on April 4, how to see — PAGASA

Kristofer Purnell - Philstar.com

MANILA, Philippines — The Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAGASA) announced there would be a planetary alignment involving four planets during the early hours of April 4 over Philippine skies.

Venus, Neptune, Saturn, and Mars will be aligned on the morning of April 4.

PAGASA describes a planetary alignment as an Astronomy term for when multiple planets gather closely on one side of the sun at the same time.

"This provides a stunning celestial display that can be observed without the need for special astronomical equipment," added PAGASA.

Venus, Saturn, and Mars can all be seen with the naked eye, while a good view of Neptune will require a modest telescope or high-powered binoculars.

"Venus can be seen lying very low in the morning sky. Mars and Saturn will be sitting low on the eastern horizon and will remain visible until the end of the month," the agency said.

The largest planet in the Solar System, Jupiter, can be seen in the western sky after sunset, though it will difficult to observe toward the end of April because of the sun's glare, while the smallest planet Mercury won’t be visible because of its proximity to the sun.

Two years ago, Mercury, Venus, Mars, Jupiter and Saturn aligned in their natural order from the sun for the first time in 18 years.

Other astronomical events PAGASA noted for April are the Lyrid Meteor Shower during the month's second half (peaking on the 22nd), the passage of Comet 12P/Pons-Brooks, and excellent views of constellations Ursa Major, Leo, Leo Minor, Hydra, Sextans, Crater, and Antlia.

Comet 12P/Pons-Brooks will reach its brightest point and pass perihelion on April 21 and will be visible through the use of a small telescope or 40-50mm aperture binoculars, however, PAGASA noted given its proximity to the sun that the comet might easily disappear into the sunset glow.

The agency also said April is the best time to look at famous deep sky objects such as the Cigar Galaxy, the Pinwheel Galaxy, the Owl Nebula, the Leo Triplet of galaxies, and the Southern Pinwheel Galaxy.

Bleibt Ihre Rente noch steuerfrei?

Von: Jörg Leine, Merkur

Ab Juli steigt die gesetzliche Rente um 4,57 Prozent. Aber: Müssen Sie Ihre Rente deshalb jetzt versteuern? Der Geldratgeber Finanztip erklärt Ihnen, wann das so ist – und wann nicht.

Rentnerinnen und Rentner können sich ab Juli über ein Plus von 4,57 Prozent freuen – und zwar deutschlandweit gleichermaßen. Durch die Rentenerhöhung könnten Sie aber in die Steuerpflicht rutschen.

Es ist aber auch möglich, dass Sie trotz der Erhöhung sogar aus der Steuerpflicht herausfallen. Denn 2024 ist auch der steuerliche Grundfreibetrag gestiegen: für Alleinstehende von 10.908 Euro (2023) auf 11.604 Euro. Das entspricht einer Steigerung von 6,38 Prozent – also mehr als der Rentenanstieg. Bei Verheirateten gilt der doppelte Grundfreibetrag.

Wann müssen Rentner Steuern zahlen?

Eine Steuererklärung müssen Sie erst abgeben, wenn Ihre Brutto-Jahresrente nach Abzug Ihres persönlichen Rentenfreibetrags den Grundfreibetrag übersteigt. Wie hoch Ihr Rentenfreibetrag ist, hängt davon ab, wie viel Ihrer Rente besteuert wird. Ausschlaggebend dafür ist wiederum, in welchem Jahr Sie in Rente gegangen sind. Werfen Sie dazu einen Blick auf die Finanztip-Steuertabellen. Der Rentenfreibetrag wird genau nach einem Jahr Rentenbezug einmalig errechnet – und bis an Ihr Lebensende festgeschrieben.

Zum Beispiel: Sie bekommen seit 1. Januar 2022 monatlich 1.400 Euro Rente. Mitte 2022 gab es eine Rentenerhöhung um 5,35 Prozent. Dadurch hatten Sie am Ende des ersten vollen Rentenjahres Gesamteinkünfte von rund 17.250 Euro. Weil Sie 2022 in Rente gegangen sind, sind 82 Prozent Ihrer Rente steuerpflichtig, also genau 14.145 Euro. Zieht man diesen Besteuerungsanteil von Ihrer Gesamtrente ab (17.250 Euro - 14.145 Euro), ergibt sich ein Rentenfreibetrag von 3.105 Euro. Dieser ändert sich auch nicht mehr – selbst wenn Ihre Rente künftig erhöht wird.

Bis zu welchem Betrag ist Ihre Brutto-Rente 2024 steuerfrei?

Grundsätzlich gilt: Je früher Sie in Rente gegangen sind, desto mehr gesetzliche Rente dürfen Sie beziehen, ohne in die Steuerpflicht zu rutschen. Wie hoch Ihre Brutto-Rente 2024 maximal sein darf, damit sie steuerfrei bleibt, haben die Experten von Finanztip anhand von drei Beispielen (Rentenbeginn 2005, 2015 und 2023) für Sie berechnet:

MEINE NEWS

Hinweis zu den Tabellen: Die Zahlen stellen die Brutto-Rente dar, also Ihre gesetzliche Rente, von der noch 8,15 Prozent Krankenversicherungsbeitrag und 3,4 Prozent Pflegeversicherungsbeitrag abgehen. Die Monatsrenten aus Spalte 2 und 3 bekommen Sie jeweils für sechs Monate, da die Rentenerhöhung ab Juli für die zweite Jahreshälfte gilt. Das heißt, Sie multiplizieren beide Zahlen mit 6. Zusammengerechnet erhalten Sie die maximale Brutto-Jahresrente, bis zu der Ihre Rente steuerfrei bleibt. Zum Beispiel für 2015/Ost: (1.434 Euro x 6) + (1.499 Euro x 6) = 17.599 Euro.

Wie viel Brutto-Rente (monatlich und jährlich) Sie 2024 bekommen dürfen, um steuerfrei zu bleiben, können Sie in der Finanztip-Tabelle zur Rentenbesteuerung nachschauen. Überschreiten Sie diese Grenze, kann es sein, dass Sie Steuern zahlen müssen. Das kann vor allem dann passieren, wenn Sie zusätzliches steuerpflichtiges Einkommen (z. B. durch Mieteinnahmen, Teilzeitjob) haben.

Wann ist eine Steuererklärung fällig?

Liegt Ihre Brutto-Jahresrente über dem Maximalbetrag aus der Finanztip-Tabelle, müssen Sie eine Steuererklärung abgeben. Allerdings können Sie über diese auch Werbungskosten, Sonderausgaben, außergewöhnliche Belastungen und noch mehr absetzen. Es ist also durchaus möglich, dass Sie am Ende doch keine (oder zumindest weniger) Steuern zahlen müssen. Wie das genau funktioniert, erfahren Sie direkt im Finanztip-Ratgeber zur Rentenbesteuerung.

.jpg)